Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

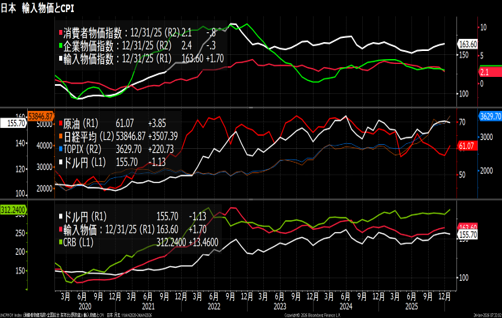

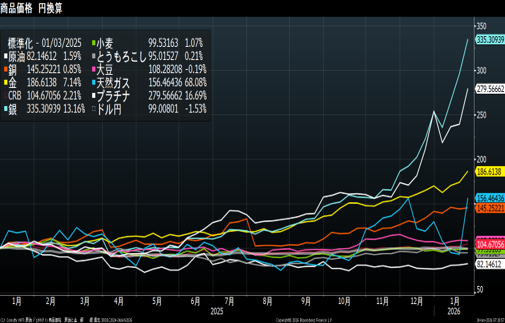

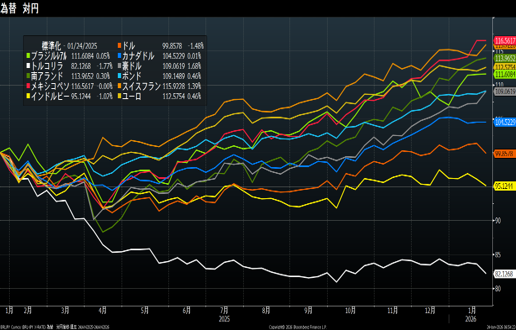

The yen surged in the New York market on Friday, trading at around 155 yen. Since last year, crude oil and grain prices have been sluggish, keeping import prices stable. An excessively weak yen pushes up import prices, ultimately affecting consumer prices, so a yen weakening around 160 yen is unacceptable.

I believe the Bank of Japan will raise its policy interest rate at least twice this year, and personally, three times. Japan’s real interest rate is negative. Once this is resolved, the yen will return to normal levels.

Due to the yen’s appreciation, Nikkei 225 futures fell sharply.

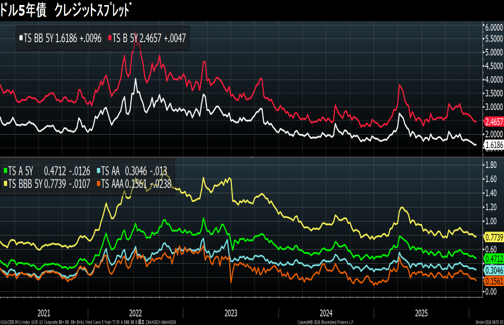

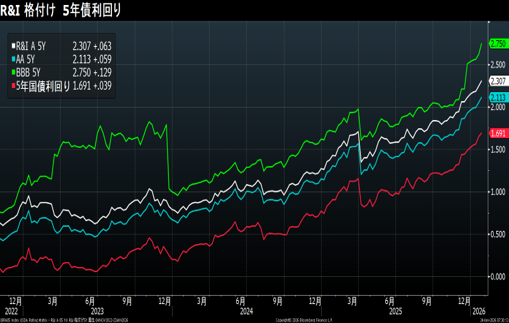

U.S. Credit: Flat

Credit markets are flat.

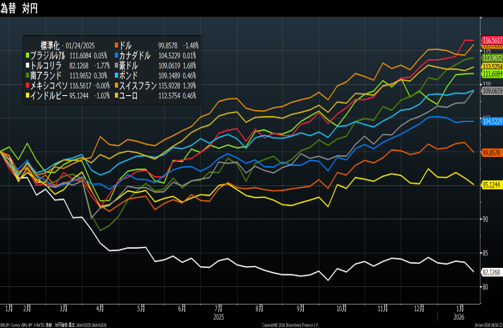

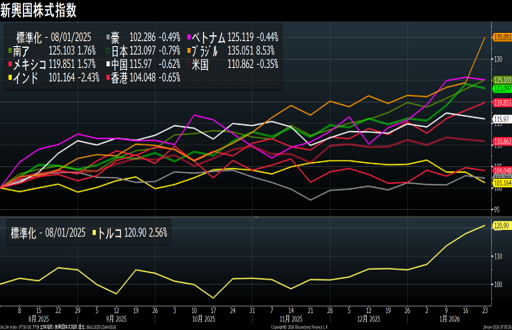

Emerging Markets: Brazil surged.

Brazil’s Bovespa index and Turkey’s XU-100 index both hit new highs. The real is being bought against the yen. Meanwhile, while the Turkish lira is on a downward trend, the gains in individual stocks are more than offsetting the currency’s decline.

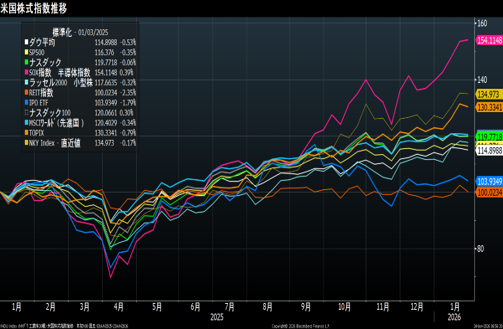

US Stocks: Tracing Highs

US stocks are trending high. Earnings reports will begin in earnest next week. The market will likely fluctuate between excitement and despair depending on the results.

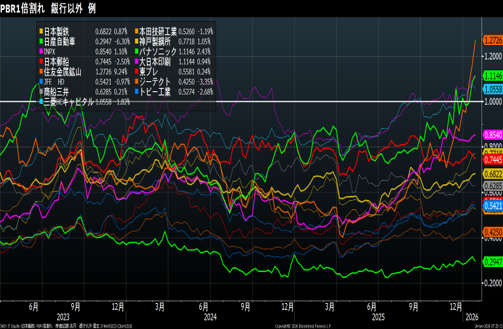

Japanese Stocks: Large Value

The strong yen is likely to hold down stock prices next week. Earnings announcements will also begin in earnest in Japan next week. Japanese stocks are a treasure trove of undervalued stocks, so buy when they sell off. Low PBRs are a good target.

Five years from now, companies with PBRs below 1x may have disappeared from the market. Companies are also being asked to manage their business with an awareness of capital costs. This trend will continue.

The Caterpillar-Komatsu ratio has fallen to 8.6x. Is Caterpillar overbought, or Komatsu too cheap? The two companies are in the same industry but with different business segments. Caterpillar’s earnings report highlights sales from its generator business for AI servers.

Japanese Bond Market

Interest rates are rising, primarily for ultra-long-term bonds. Rising interest rates are normalizing, and this trend cannot be stopped.

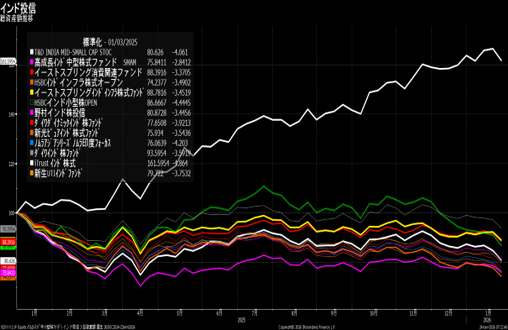

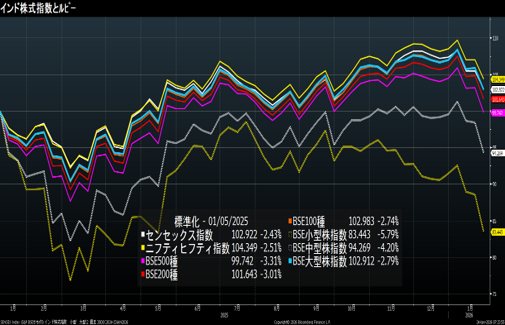

Indian Stocks: Indian Stocks Are Tough for Foreigners

The Indian stock market is closed. India is currently experiencing an unprecedented IPO boom. Foreigners are not allowed to participate. While Japanese and US stocks are booming, the Indian stock index is sluggish.

Domestic Indian mutual funds (12 stocks) have seen approximately ¥90 billion in outflows in just one week.

This is the time to persevere. Long-term investment is best in India. Let’s get through this with regular investments.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified Securities Analysts Association (CMA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年1月24日The yen surges! Buy Japanese stocks when they are sold.

未分類2026年1月24日The yen surges! Buy Japanese stocks when they are sold. 未分類2026年1月24日円が急伸!株は売られたら買い

未分類2026年1月24日円が急伸!株は売られたら買い 未分類2026年1月17日Japanese stocks: Waiting for a pullback, but no pullback

未分類2026年1月17日Japanese stocks: Waiting for a pullback, but no pullback 未分類2026年1月17日日本株、押し目待ちの押し目なし

未分類2026年1月17日日本株、押し目待ちの押し目なし