Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

The past year has flown by. My portfolio’s performance this year was 18.5%, below the Nikkei average’s 27%. Core stocks like Komatsu and Nippon Steel dragged down the overall performance. Stocks with strong gains included Fujikura, Caterpillar, SBS, and ENGI, all up over 60%. The worst performer was Vanke, down 36%. I invested ¥250,000 in this stock around 2004, and it briefly rose to nearly ¥15 million. Then, Xi Jinping’s policies burst the real estate bubble, leading to a default. Next year, there are many corporate bond redemptions, so the situation is quite dire. The valuation has fallen to ¥1.5 million. I wasn’t happy selling it because the dividend was high, but now there’s no dividend. I’ll sell it next year.

Predictions for the Japanese Market Next Year

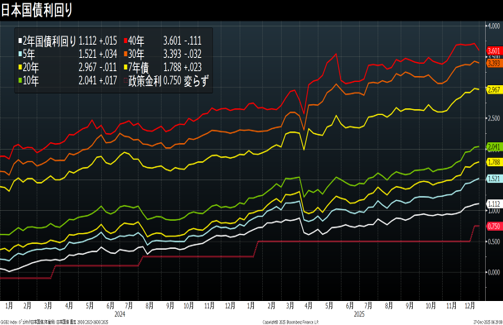

Bond Market: Interest Rates Rise, 10-Year JGBs to 2.5%

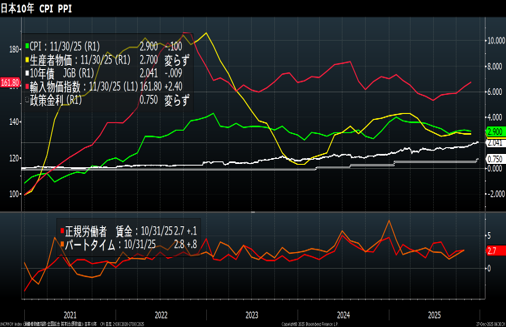

Next year, the Bank of Japan is likely to raise its policy interest rate from the current 0.75% to around 1.5%. The current inflation rate is 2.9%. This is due to the high policy interest rate of 0.75% and the high real interest rate of 2.15%.

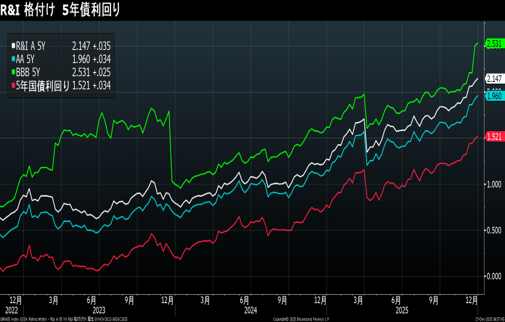

The 10-year bond yield is likely to aim for 2.5%. In the credit market, credit spreads are expected to widen as government bond interest rates rise.

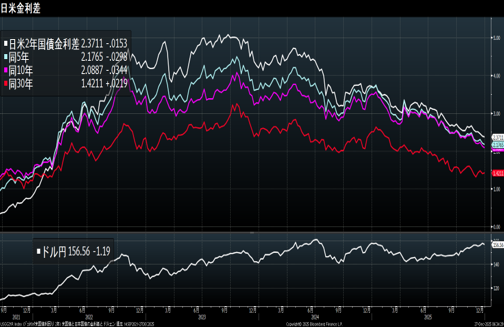

– USD/JPY: Strong Yen

With the Bank of Japan’s interest rate hike, the interest rate differential between Japan and the US will narrow. This will lead to a reversal of the yen carry trade. The USD/JPY will likely aim for 135.

– Stock Market: Nikkei Average Aims for 70,000 Yen

Japanese companies are increasingly focusing on capital costs. Management is becoming increasingly aware of WACC, ROIC, CAPM, ROE, and other metrics.

A future challenge is rising stock prices as companies sell off business segments that are not cost-effective.

With US stocks overvalued and the Chinese economy sluggish, investment capital is flowing into Japan. We expect the yen to appreciate and stock prices to soar, similar to the Japanese stock market in the 1980s.

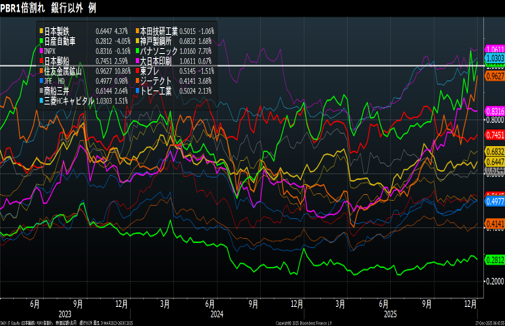

Of the 1,665 TOPIX constituents, 587 have a PBR below 1. Of the 1,595 Prime Market stocks, 541 have a PBR below 1, and 828 of the 1,558 Standard Market stocks have a PBR below 1. We can expect these companies with PBRs below 1 to be boosted.

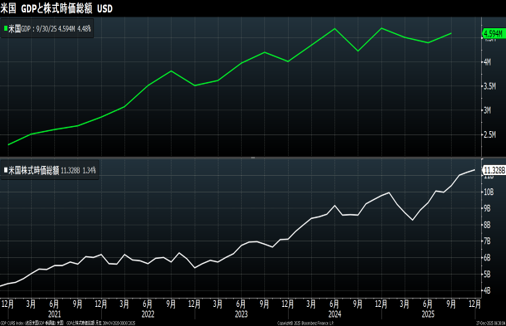

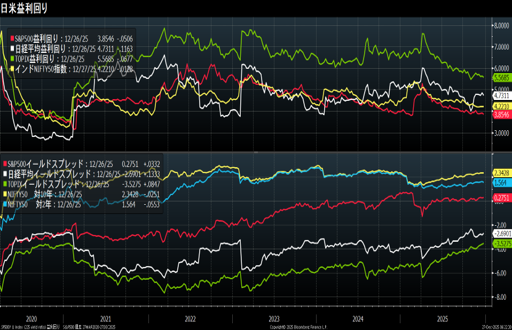

– US Stocks: Fall

The US stock market is overvalued when considering indices such as GDP ratios and yield spreads. It’s a situation where the bottom could fall at any time. US stocks are generally high, so a collapse is a threat. While this will have an impact on Japan, undervalued Japanese stocks are likely to be bought.

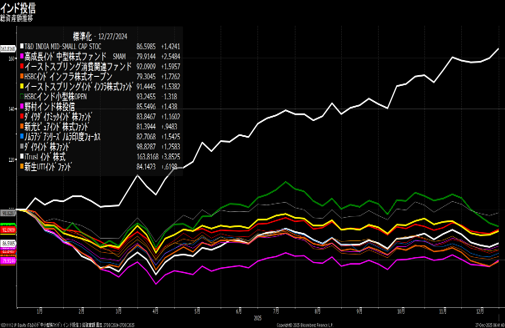

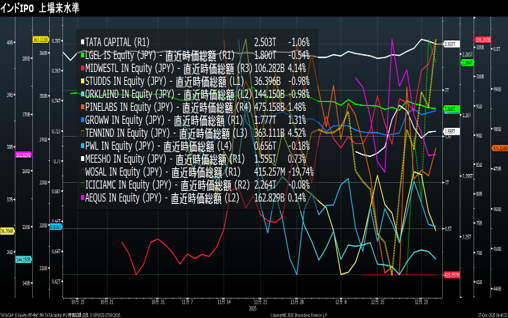

– India: The IPO Boom Will Continue Next Year

The Indian stock market has been disappointing this year. Major Indian mutual funds sold in Japan have performed poorly, with assets declining. The HSB Small Cap Open and Nomura Asia Series India have seen notable declines, with returns of around -11%.

This year, India saw a notable number of IPOs with market capitalizations exceeding ¥1 trillion. Among them are TATA Capital and ICICI Prudential AM, with over ¥2 trillion in capital, LG Electronics Ind, Billionbrains, and Meesho, with over ¥1 trillion in capital. Next year, new listings are expected, including Reliance Jio, PhonePay, SBI Mutual Fund, NSE IPO, and Zepto. NSE is India’s largest stock exchange, and its market capitalization could exceed ¥5 trillion.

Data: Bloomberg

Certified Manager of Securities Analysts (CMA)

Certified International Investment Analyst (CIIA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月14日Komatsu’s momentum is unstoppable

未分類2026年2月14日Komatsu’s momentum is unstoppable 未分類2026年2月14日コマツの勢いが止まらない

未分類2026年2月14日コマツの勢いが止まらない 未分類2026年2月7日Software to hardware. Capital is shifting dramatically.

未分類2026年2月7日Software to hardware. Capital is shifting dramatically. 未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く

未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く