Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

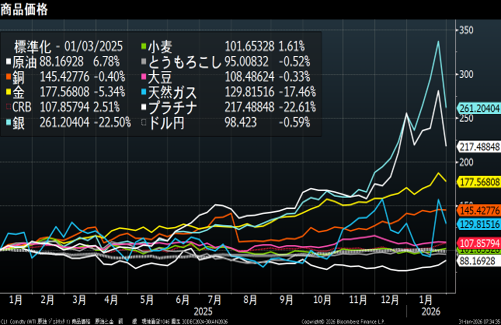

Commodity markets have been volatile this week. Silver, platinum, and natural gas plummeted by about 20%, and Bitcoin also fell. Meanwhile, crude oil rebounded.

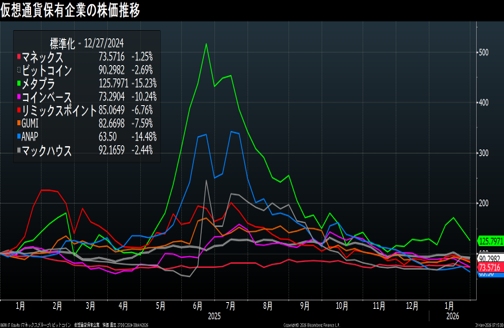

Share prices of companies holding cryptocurrencies also fell sharply. This is a normal trend, as it was strange for stock prices to rise simply because of cryptocurrency holdings.

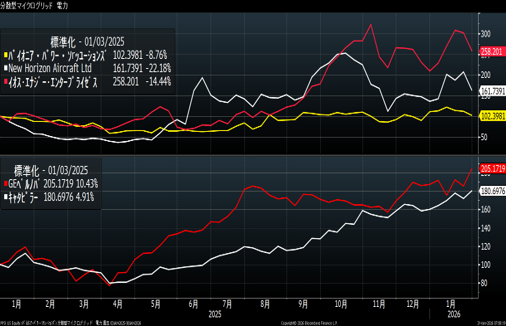

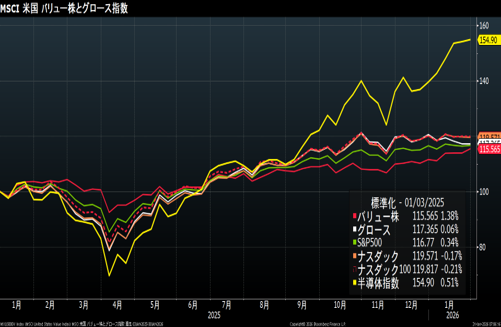

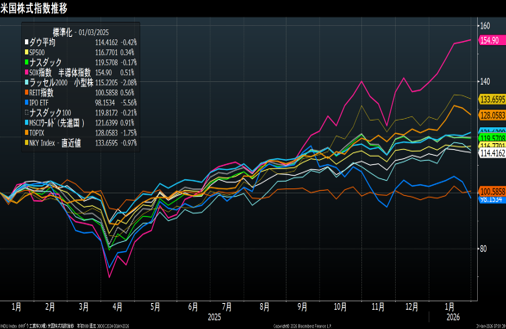

In the stock market, SAP’s stock price plummeted as investors were discouraged by the slowdown in cloud orders. Microgrid companies’ stock prices also fell. Among U.S. stock indexes and ETFs, the U.S. IPO ETF fell 5.5% and the Russell 2000 fell 2.08% week-on-week, indicating an outflow of funds from small-cap stocks. Funds are flowing into value and short-term/mid-term bonds.

Are dark clouds looming?

– Japanese Stock Market: Value-focused Buying

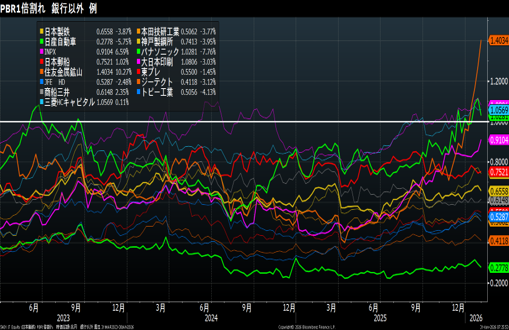

Of the 1,666 companies in the TOPIX, 556 have a P/B ratio below 1. The Tokyo Stock Exchange will begin publishing a list of companies disclosing their cost of capital starting January 15th. The revised list of capital cost disclosures in the Corporate Governance Report should also be included in the Tokyo Stock Exchange’s monthly “List of Disclosing Companies.” Monthly updates allow investors to monitor the level of corporate initiatives.

It is believed that corporate initiatives will be more easily reflected in stock prices.

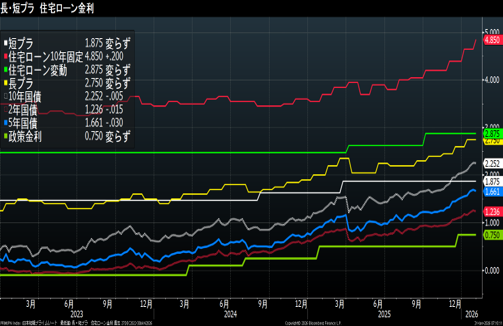

– Japan’s Bond Market: 10-Year Fixed Mortgage Rate Increased by 0.2%

The 10-year fixed mortgage rate rose by 0.2% to 4.85%. The short-term flat rate for variable mortgage loans was raised by 25 basis points on February 2nd, and is expected to rise accordingly. Taking the CPI into account, a policy interest rate of 1.5% (currently 0.75%) would not be surprising. Loan interest rates are likely to rise further.

The results of the much-anticipated 40-year government bond auction (18th issue, nominal coupon 3.1%) were favorable. Demand appears to have been strong from life insurance companies focused on direct returns. Ultra-long-term bonds are polarized, and there are no investors for low-coupon ultra-long-term bonds.

Repackaging likely won’t work. Create an IDECO investment trust by asset swapping ultra-long-term, deep-under government bonds! IDECO may be a good option because it cannot be canceled mid-term.

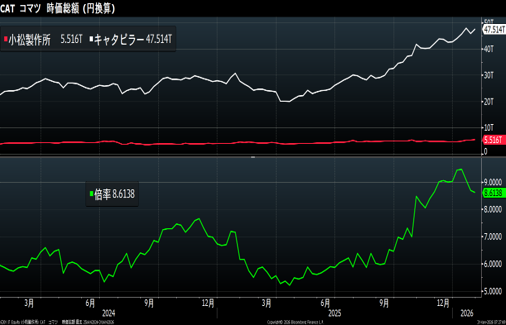

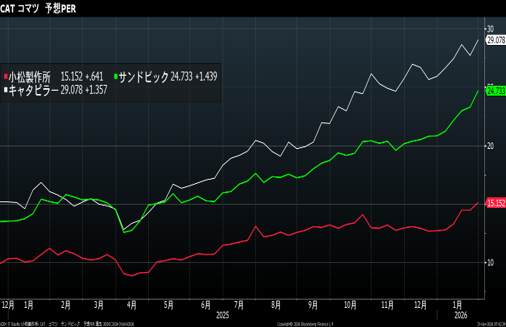

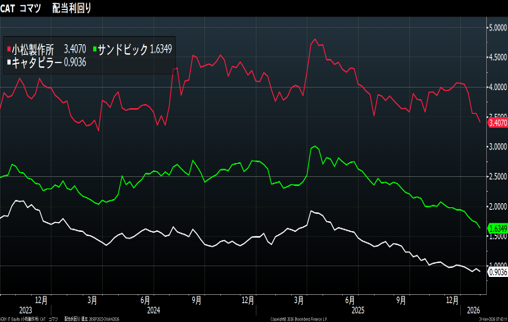

Komatsu and Caterpillar

Both companies announced their financial results this week. Caterpillar’s stock price soared due to solid sales to AI data centers (up 24% from the previous quarter). Meanwhile, Komatsu’s results were met with disapproval, causing its stock price to fall after the announcement. However, it was subsequently bought back, closing at a record high.

Komatsu is the world’s second-largest construction machinery manufacturer, but Caterpillar’s market capitalization is ¥47.5 trillion, about eight times Komatsu’s. Komatsu’s market capitalization is even lower than Sandvik (Sweden), the 10th-largest manufacturer by sales.

Expected P/E ratios are 15x for Komatsu, 29x for Caterpillar, and 24.7x for Sandvik.

Komatsu’s dividend yield is 3.4%, Caterpillar’s is 0.9%, and Sandvik’s is 1.6%.

Komatsu’s business segments are construction machinery and retail finance. Slumping sales in the Asian market are dragging down its performance.

The company’s fiscal 2025 earnings forecast remains unchanged from the previous forecast.

Stock prices are still rising. This may be a correction in the value of undervalued stocks.

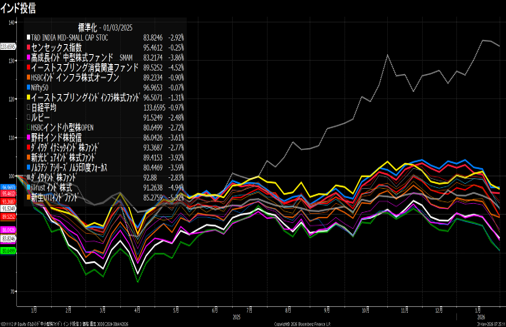

India: NSE Prepares for IPO

The Indian stock market has seen a buyback, but the balance of Indian mutual funds sold in Japan is declining. With the temporary boom over, foreign investors are withdrawing funds from Indian stocks.

Meanwhile, IPOs are booming in India. India’s largest stock exchange, the NSE, has finally begun preparations for its IPO. The Bombay Stock Exchange, which is already listed, has a market capitalization of approximately 1.9 trillion yen (revenues of approximately 63 billion yen). NSE’s revenues are approximately 131 billion yen, roughly double those of the BSE. Its market capitalization will likely surpass that of CBOE, the world’s largest exchange, which has a market capitalization of approximately ¥4.3 trillion.

Indian stocks are decoupled between foreign and domestic investors.

India is a growing country, so foreign investors should steadily accumulate index funds.

Good things will happen in 10 or 20 years.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified Manager of Securities Analysts (CMA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年1月31日Komatsu hits new high, valuation reassessment?

未分類2026年1月31日Komatsu hits new high, valuation reassessment? 未分類2026年1月31日コマツが高値更新、バリュエーションの見直しか

未分類2026年1月31日コマツが高値更新、バリュエーションの見直しか 未分類2026年1月24日The yen surges! Buy Japanese stocks when they are sold.

未分類2026年1月24日The yen surges! Buy Japanese stocks when they are sold. 未分類2026年1月24日円が急伸!株は売られたら買い

未分類2026年1月24日円が急伸!株は売られたら買い