Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

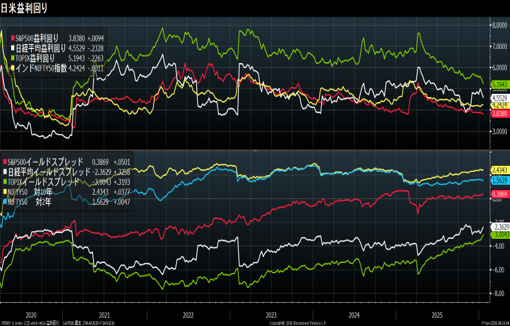

The Nikkei average has risen 7.14% since the beginning of the year, significantly outpacing the Dow Jones Industrial Average’s 2.77% and the S&P 500’s 1.54%. My portfolio has also risen 11%, an unprecedented increase in such a short period of time.

This is due to the rise in semiconductor-related and value stocks. Japanese stocks are still undervalued, so the value stock market will likely continue to rise. Now is the time to invest in Japanese stocks, not the US.

– Japanese Stock Market

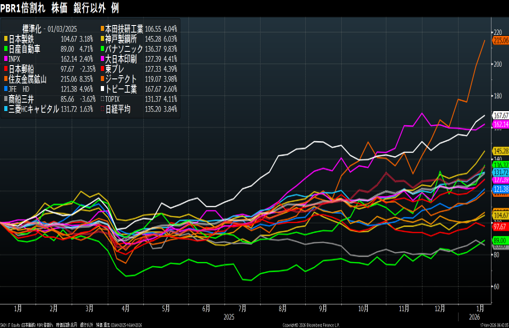

The Nikkei average rose 3.84% this week. In contrast, Honda, with a P/B below 1, outperformed the Nikkei with 4.04%, Kobe Steel, 6.03%, Topre, 4.39%, and Nissan, 4.71%.

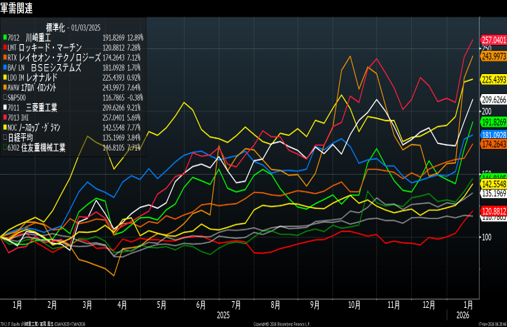

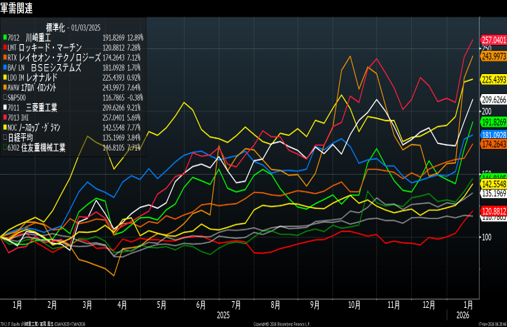

Semiconductor-related, defense-related, and rare earth-related stocks have risen significantly, but they are already at overvalued levels.

While expectations for an upswing are high, some stocks have already sold to levels where they could easily lose half their value if they fall. Therefore, if you’re investing in the stock market now, I think it’s best to look for solid stocks with a PBR below 1x.

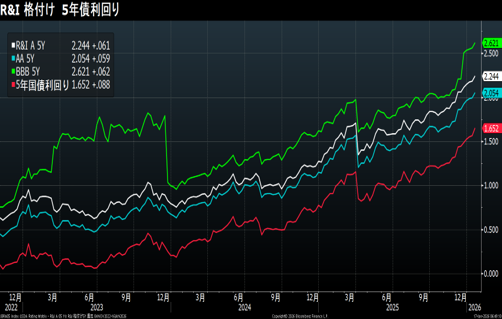

– Japan’s Bond Market: Corporate Bonds Heading for a 2% 5-Year Era

The short-term interest rate will be raised by 0.25% from 1.875% to 2.125% on February 2nd. Variable-rate mortgages have a short-term interest rate plus 1%, so they could be raised to 3.125%. Japanese government bond interest rates continue to rise, with 2-year bonds at 1.2% and 5-year bonds at 1.65%. The current policy interest rate is 0.75%, but it’s not surprising that they could rise to 1.5%.

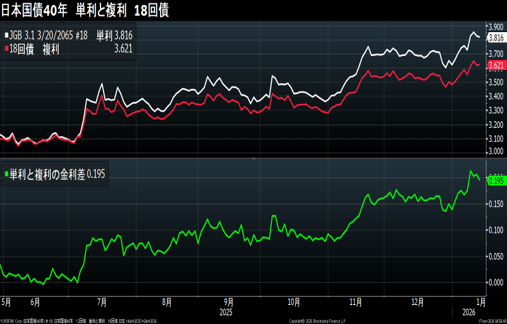

– Simple Interest and Compound Interest

Currently, the prices of low-coupon, ultra-long-term bonds in the Japanese government bond market are well below face value.

Japanese government bonds are traded at simple interest rates according to trading practices. The problem with ultra-long-term low-coupon bonds is the large discrepancy between simple and compound interest rates. The figure shows the trends in compound and simple interest rates for a 40-year, 0.5% coupon, 12th issue bond. The price is the same, but the simple interest rate is 5.29% while the compound interest rate is 3.40%. The term is different, but the 40-year 3.1% coupon.

The 18th bond has a simple interest rate of 3.81% while the compound interest rate is 3.62%. Bonds trading significantly below par value rarely offer coupons, so you need to consider compound interest. Be careful when investing.

– US Stocks: Beware

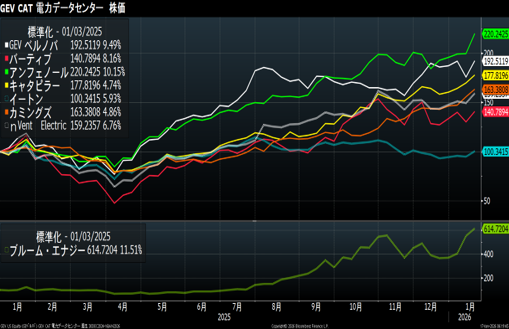

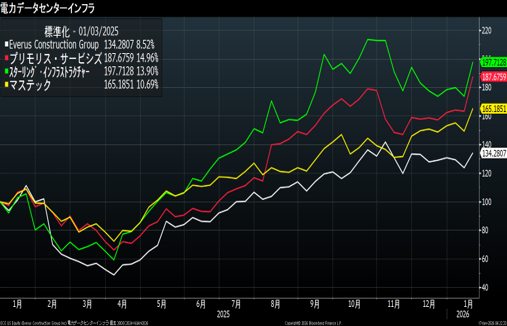

US stocks are overvalued. Defense, power, data center, and semiconductor-related stocks are driving the market.

Caterpillar hits a new high, with its market capitalization at approximately ¥48 trillion, nine times that of Komatsu.

– India: The IPO boom will continue next year.

The Indian stock market is sluggish. Capital is flowing into the IPO market. An IPO on India’s largest stock exchange, the NSE, is likely to be finalized this month.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified by the Society of Securities Analysts (CMA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月28日Nippon Steel CB issued: Aggressive conversion price

未分類2026年2月28日Nippon Steel CB issued: Aggressive conversion price 未分類2026年2月28日日本製鉄CB発行 強気の転換価格

未分類2026年2月28日日本製鉄CB発行 強気の転換価格 未分類2026年2月22日Goodbye FAANG!

未分類2026年2月22日Goodbye FAANG! 未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?

未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?