Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

Both the Japanese and US stock markets are off to a rocket start. If this trend continues, the Nikkei average will likely reach the 70,000 yen range by the end of the year. While US stocks appear overvalued, capital inflows into the US stock market are likely to continue amid President Trump’s tough global policies.

Meanwhile, Japanese bond interest rates still have room to rise. The 10-year Treasury yield is likely moving toward 2.5%. The policy interest rate will be raised to 1.5% by the end of the year, with 5-year Treasury bonds likely to reach 2%.

As interest rates rise, mortgage rates will also rise. Mizuho Bank, Mitsubishi UFJ Bank, and others announced hikes in their short-term prime rates from 1.875% to 2.125% on February 2nd.

With the short-term prime rate hike, variable mortgage rates will likely rise to 3.125% in the future. With the policy interest rate potentially rising to 1.5% this year, variable mortgage rates are likely to rise another 0.75%.

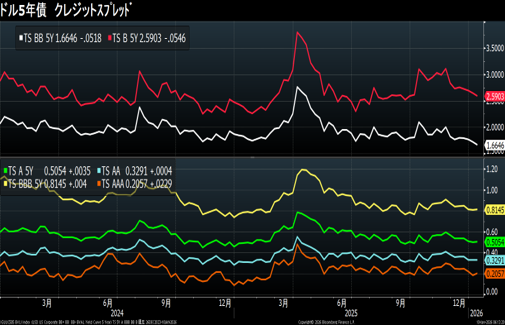

US Credit: Risk-On

The credit market is risk-on. Funds are flowing into junk stocks.

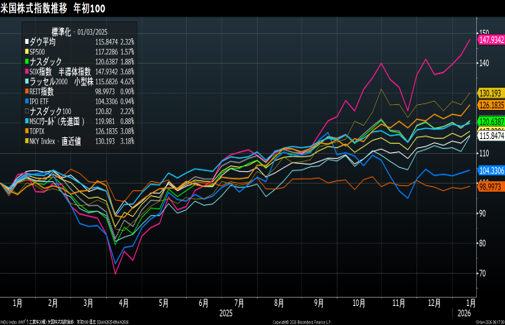

US Stocks: Small Cap and Semiconductors

The Russell 2000 small-cap index and the SOX semiconductor index are outperforming the S&P 500. Beware of the tendency for funds to flow into small caps at the end of a big market, pushing up the market and bringing an end to the bull market. It’s probably time to sell overvalued stocks.

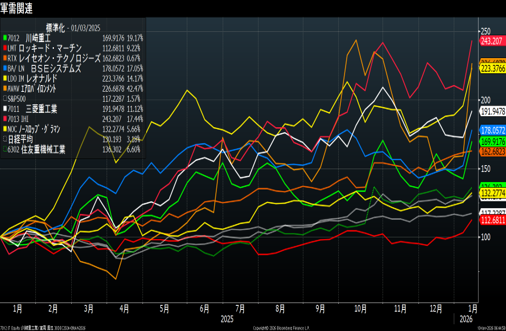

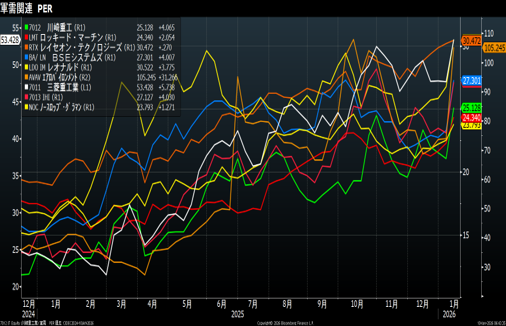

If you’re looking to invest, look to defense and aerospace. With SpaceX’s upcoming IPO, space-related themes are likely to be a hot topic this year.

Japanese Stocks: Semiconductors and Defense Demand Solid

CME Nikkei 225 futures soared on the back of positive reactions to the news of the House of Representatives dissolution. Tokyo Electron rose by around ¥2,400, equivalent to ¥40,000, and F-Retail rose by roughly ¥1,200 to ¥21,077.

If this trend continues, the Nikkei 225 could very well reach the ¥60,000 range by March.

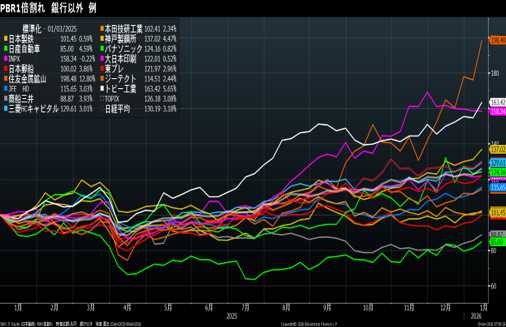

Meanwhile, the Tokyo Stock Exchange’s stock price reforms have seen a steady inflow of funds into stocks with PBRs below 1. While the Nikkei average rose 3.18% (compared to the previous week), Topy Industries rose 5.65%, Mitsui O.S.K. Lines 3.93%, and Nippon Yusen Kaisha 3.86%. Kobe Steel, with a 4.47% increase, was a notable outperformer.

This trend is expected to continue, so those hesitant to invest should choose these stocks with low downside risk.

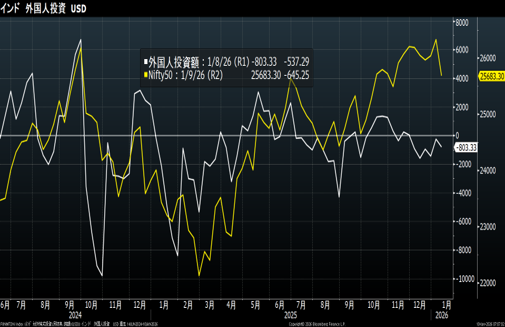

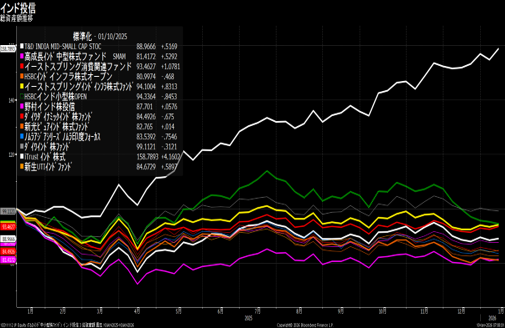

Indian Stocks: IPO Boom

Foreign investors continue to lose capital to the Indian stock market. While individual stock investments (except for ADRs) are not available, Indian stocks are not suitable for short-term trading. However, the country’s high growth prospects make them suitable for regular investment. The Indian government aims to become a developed country by 2047. While the penetration rate of white goods is low, consumer spending is increasing due to the growing middle-income class. By investing, you have the potential to reap double the benefits of currency and stock prices over the next 20 years.

I invest 200,000 yen in mutual funds each year through my NISA account and 10,000 yen per month through my monthly investment fund.

Data: Bloomberg

Certified Securities Analysts Association (CMA)

Certified International Investment Analyst (CIIA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月22日Goodbye FAANG!

未分類2026年2月22日Goodbye FAANG! 未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?

未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?  未分類2026年2月14日Komatsu’s momentum is unstoppable

未分類2026年2月14日Komatsu’s momentum is unstoppable 未分類2026年2月14日コマツの勢いが止まらない

未分類2026年2月14日コマツの勢いが止まらない