Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

Tomorrow is the House of Representatives election. I’m supporting Mitsuru Imamura in Tokyo’s 2nd District. His mission aligns with mine. These are healthcare reform and pension issues. Japan’s population is aging. The average life expectancy for Japanese people is 81 years for men and 87 years for women. Meanwhile, the average healthy life expectancy is 7.14 years for men and 74.79 years for women. According to data from the Ministry of Health, Labor and Welfare, over the past six years, the average life expectancy for men has increased by 2.91 years and for women by 2.21 years. Healthy life expectancy, at 2.74 years and 1.84 years, respectively, is lower than the increase in average life expectancy. This means the number of elderly people in poor health is increasing.

Past estimates suggest that the number of bedridden elderly people increased from approximately 900,000 in 1993 to 1.7 million in 2010 and approximately 2.3 million by 2025. Advances in medical care are driving the increase in the number of bedridden elderly people.

The problem here is pensions. Pensions are paid as long as you’re alive. The issues then arise: medical expenses and pensions. The average employee pension is around 160,000 yen. Assuming an annual income of around 2 million yen, under the high-cost medical care system (the upper limit of medical expenses based on annual income is around 57,000 yen per month. In other words, the net result is a positive 103,000 yen. As long as the elderly person is in a vegetable state and survives, this is a positive. Is this really okay?

Shouldn’t it at least be the same amount, or a negative amount? I understand the desire of family members to want the person to live on. Japan is the only country with a system like this.

Medical care advances, the number of vegetable states increases, and with that, pensions will dry up. Is this okay?

The person who can resolve this contradiction is Dr. Imamura. He is not a member of the Medical Association.

If he were a politician, he would be able to fight hard.

It would be bad for the LDP to win alone Yes. Vote for a party other than the LDP in the proportional representation election.

〇Stock Market: Hello, Hardware Companies, Goodbye, Software Companies

A major trend is occurring in the global stock market. Software-related companies, which had been performing strongly until now, have plummeted, while capital goods companies and other companies are soaring.

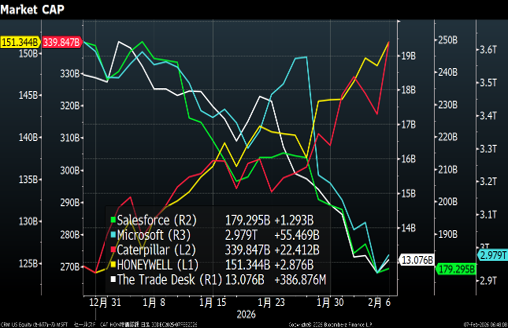

This chart shows the market capitalization trends since the end of last year for software companies Salesforce, Microsoft, and Trade Desk,

and hardware companies Honeywell and Caterpillar. The downward trend represents software-related companies, while the upward trend represents hardware companies.

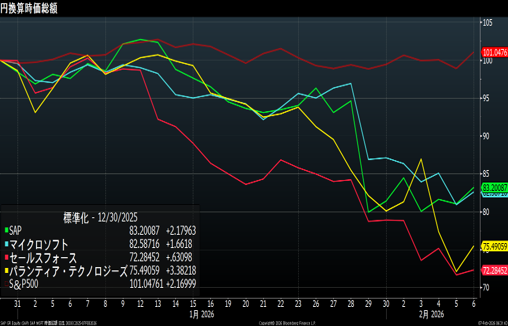

Figure 2 shows the market capitalization trends of SAP, Microsoft, Salesforce, and Valantir Technologies (end of last year = 100). While the market capitalization of the S&P 500 index is slightly positive, Salesforce’s market capitalization has already fallen by approximately 28% since the end of last year. Capital is shifting from software companies to capital goods and other companies.

I’ve never seen such a large flow of capital. Software-related companies are in dire straits. Advances in AI are calling into question the very existence of software companies.

Capital is flowing into solid companies. S&P 500 Among the index components, the top gainers were Basic Sciences, followed by Oil & Gas Equipment, Handotei Manufacturing Equipment, Application Software, Guby Advertising, and Information Processing & Outsourcing Services.

The Dow’s year-to-date performance was 4.27%. The top component gainers were Caterpillar (26.77%), Honeywell (22.19%), Microsoft (-17.05%), and Salesforce (-27.77%).

This trend is likely to continue.

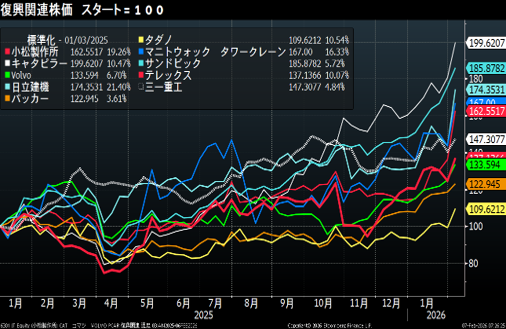

Japan: Capital Goods Soar

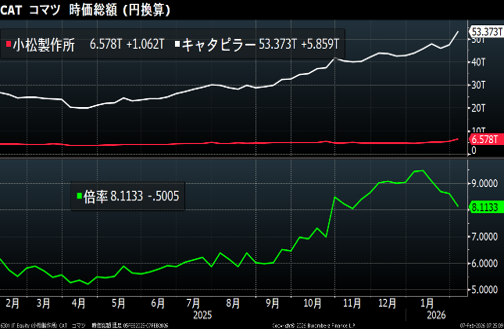

Japanese stocks are a treasure trove of undervalued stocks. This week, capital goods stocks such as Komatsu surged. Caterpillar and Komatsu’s market capitalizations increased from 8.6% last week to 8.1%. Komatsu’s market capitalization is now ¥6.57 trillion. Sandvik’s market capitalization is coming in at ¥8.1 trillion. It’s clear that Komatsu will have to surpass Sandvik’s.

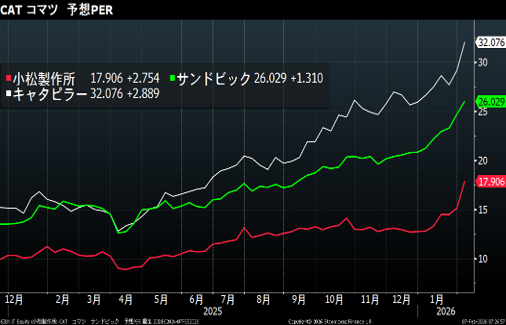

Komatsu’s P/E ratio is 17.9x, making it cheaper than Caterpillar’s 32x and Sandvik’s 26.02x.

The world’s second-largest construction machinery manufacturer.

Komatsu shares appear to be being bought by foreign pension funds. Have they finally realized how undervalued Komatsu is?

Komatsu isn’t the only one. Compared to last week, Hitachi Construction Machinery’s stock price rose 21.4% and Tadano’s 10.5%.

![]()

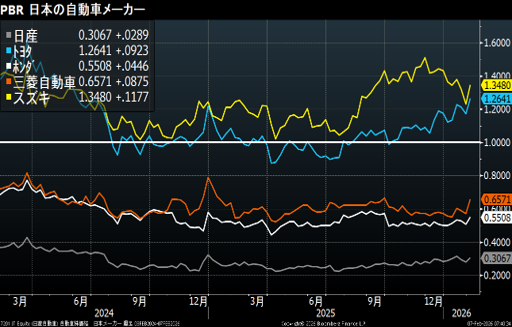

Companies with TOPIX below 1x

The number of companies with TOPIX below 1x is 534, down 22 from 556 last week. This trend is likely to continue. It seems we’ll see more and more stocks like Nasonic emerge.

Toyota and Suzuki are the only major Japanese automakers with a PBR above 1x. Who’s next?

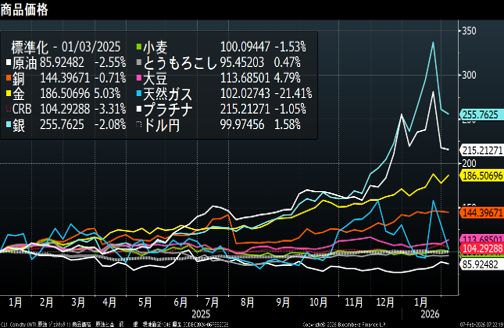

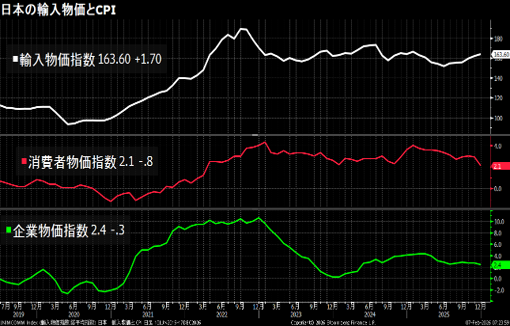

Commodities

Amid a sharp decline in natural gas prices, soybean prices rose by about 5%. Import prices remain high. If they rise significantly, they could push up domestic prices. Caution required.

Emerging Markets: Mexico and Thailand are being bought, while India is rebounding.

The US announced it would reduce tariffs on India from 50% to 18%. The rupee is being bought, and foreign investors are returning to India.

Indian mutual funds sold in Japan also saw inflows of over 100 billion yen compared to last week.

Indian stocks have been struggling since last year. Signs of a turnaround are emerging. It’s been a while since IPO.

In India, the NSE is preparing for an IPO. Its market capitalization will significantly exceed that of the JPX (¥1.7 trillion).

India is currently seeing a surge in IPO millionaires, and the middle class is also on the rise.

While India is expected to see long-term growth, individual stock investments are not available (except through ADRs).

Therefore, installment investment is the best option.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified Securities Analysts Association (CMA)

AFP

Osamu Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月7日Software to hardware. Capital is shifting dramatically.

未分類2026年2月7日Software to hardware. Capital is shifting dramatically. 未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く

未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く 未分類2026年1月31日Komatsu hits new high, valuation reassessment?

未分類2026年1月31日Komatsu hits new high, valuation reassessment? 未分類2026年1月31日コマツが高値更新、バリュエーションの見直しか

未分類2026年1月31日コマツが高値更新、バリュエーションの見直しか