Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

Pollen season is upon us. My eyes are starting to itch. I’m sure I’ll have a runny nose starting next week. I’ll need to take some medicine.

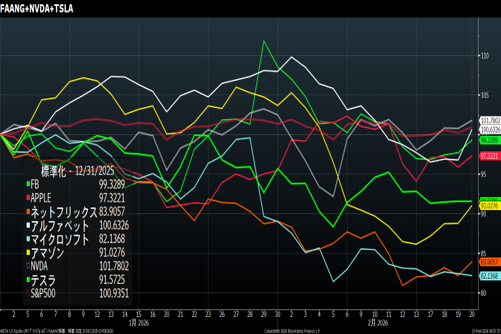

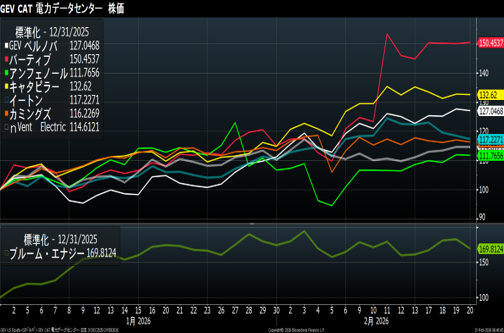

〇US Stock Market: Say Goodbye to FAANG!

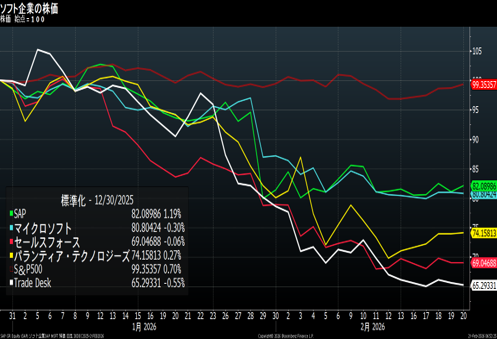

In the US stock market, the FAANG stocks, which have been driving the market until now, have stalled. It appears that capital shifts have begun. While the S&P 500 is down 0.93% year-to-date, the FAANG stocks (FB, Amazon, Apple, Netflix, Google), Microsoft, and Tesla have all underperformed. Netflix and Microsoft are down about 18%. Furthermore, capital outflows from software companies continue unabated. Trade Desk and Salesforce are down less than 30% year-to-date.

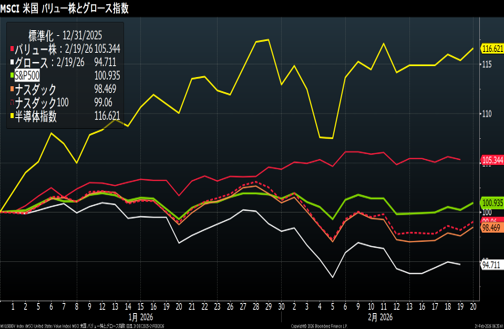

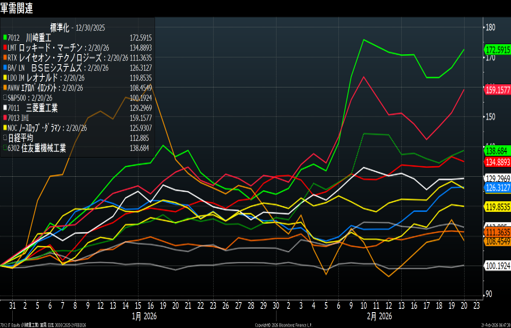

In the US stock market, capital is shifting to value, defense, power, and data center-related stocks.

The market capitalization of FAANG and other stocks has likely grown too large.

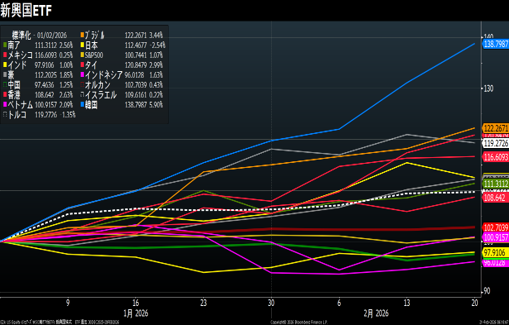

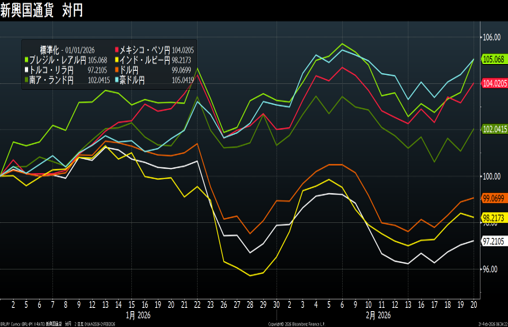

〇Emerging Markets: Brazil, Mexico, South Korea, Thailand, and Turkey

Emerging market stocks are performing strongly. Brazil and Mexico, in particular, are seeing rising stock prices and stronger currencies. Turkey’s stock market is strong, but its currency has not yet stopped weakening.

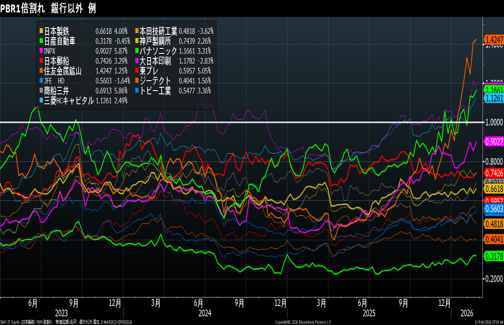

Japan: Buy

The stock market is seeing a boost from the Tokyo Stock Exchange reforms and Sanae’s “Mix” initiative.

The number of TOPIX stocks with PBRs below 1x has fallen by seven from the previous week to 510. At the end of January, the number was 556, a decline of 46. This trend is likely to continue. After real estate, Japanese stocks are next. Foreign investors are beginning to notice the low prices of Japanese stocks.

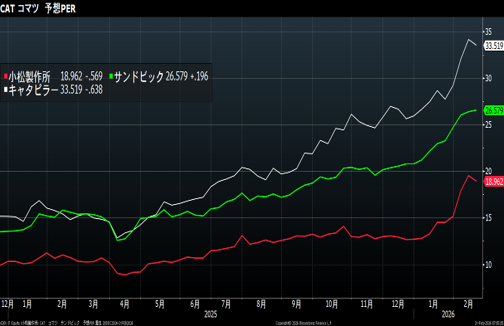

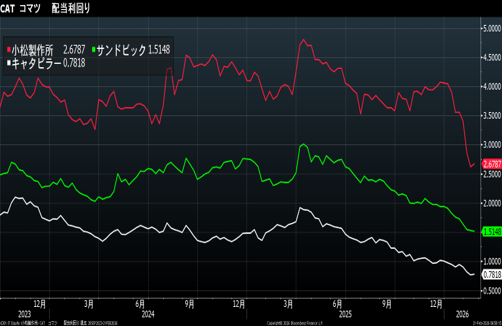

Even within the same industry, there are many stocks with completely different valuations. My pick, Komatsu, is still trading at a P/E of 19x, making it cheaper than its competitors Caterpillar (33x) and Sandvik (26.5x). Komatsu’s dividend yield is 2.67%, compared to Caterpillar’s 0.78%. Komatsu’s market capitalization is about 12% of Caterpillar’s, at ¥7 trillion. It’s unusual for the gap between the industry’s top two companies to be this wide. Komatsu’s stock price is likely to rise.

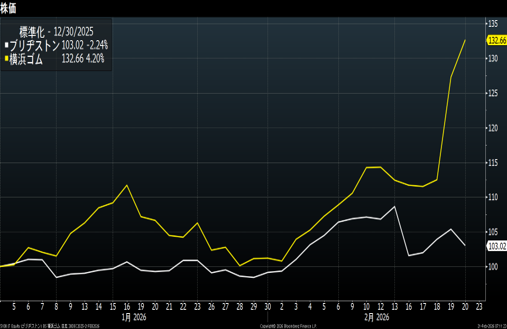

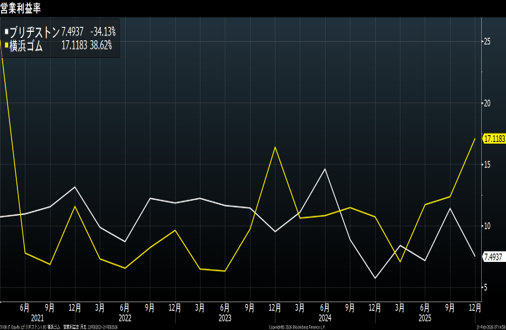

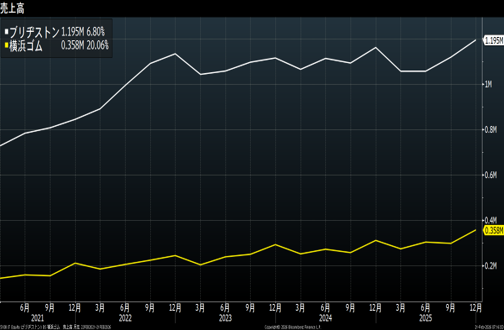

Yokohama Rubber vs. Bridgestone

Yokohama Rubber’s stock price has soared. Its year-to-date return is 32.6%, about 11 times that of Bridgestone’s (BS) 3.0%. Yokohama Rubber’s improved profit margins, driven by its management strategy, appear to be driving the stock price higher. Yokohama Rubber’s operating profit margin has been on an upward trend, most recently at 17.11% (38.6% compared to the previous quarter). Meanwhile, its BS is 7.49 (down 34.1% compared to the previous quarter). Yokohama Rubber’s sales growth rate is 20.06% (compared to the previous quarter), compared to 6.8% for its BS.

Yokohama Rubber’s P/E ratio is 11.5x, while its BS is 12.5x. While both stocks appear to be undervalued, Yokohama Rubber appears to be the clear winner.

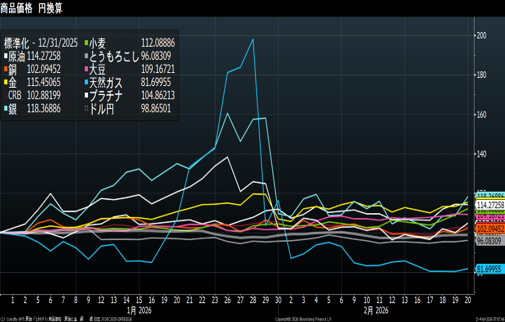

Commodities

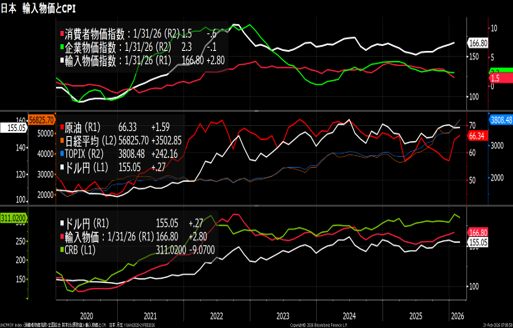

Crude oil, wheat, and soybean prices are rising. Because import prices, a leading indicator of the price index, are on an upward trend, the Corporate Goods Price Index and Consumer Price Index may begin to rise in the future.

I don’t think it will turn out like Turkey, but I’ll be keeping an eye on the dollar-yen trend.

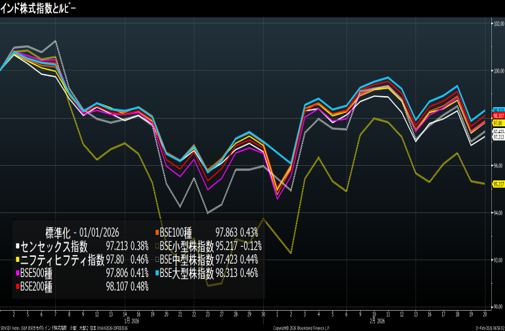

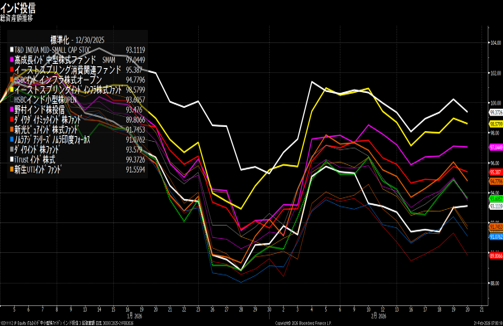

India: Long-Term Strategy

Foreign investors are net buyers of Indian stocks. Meanwhile, the net assets of investment trusts sold in Japan are declining. My investment in India is a ¥10,000 Accumulation NISA. I plan to continue this for 20 years and withdraw from it in 15 years. India’s stock market and currency are closed. Therefore, ultra-long-term investment is best. India can expect sustainable economic growth of around 7% per year. This is not a market where you can make a profit in the short term.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified Securities Analysts Association (CMA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月22日Goodbye FAANG!

未分類2026年2月22日Goodbye FAANG! 未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?

未分類2026年2月22日ブリヂストン対横浜ゴム、この差はなに?  未分類2026年2月14日Komatsu’s momentum is unstoppable

未分類2026年2月14日Komatsu’s momentum is unstoppable 未分類2026年2月14日コマツの勢いが止まらない

未分類2026年2月14日コマツの勢いが止まらない