Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: strpos() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/compat.php on line 423

Warning: preg_match() expects parameter 2 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 252

Warning: strlen() expects parameter 1 to be string, array given in /home/tfujii46636/tadd3.com/public_html/wp-includes/class-wp-block-parser.php on line 324

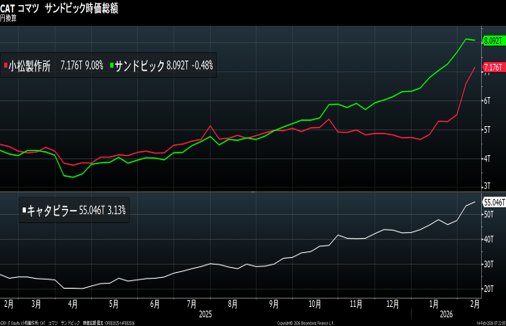

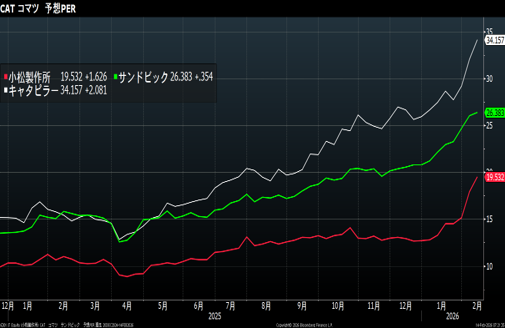

Komatsu’s stock price has soared, bringing its market capitalization to ¥7.16 trillion. It’s approaching Sandvik’s market capitalization of ¥8.09 trillion. Komatsu’s sales are ¥4.1 trillion, 2.4 times Sandvik’s. Komatsu’s expected P/E is 19.5 times, while Sandvik’s is 26.3 times. With Komatsu’s EPS at ¥350, a P/E of 26.3 translates to a stock price of ¥9,205, giving it a market capitalization of ¥8.5 trillion.

UBS has raised its target price for Komatsu to ¥9,280. The world is finally starting to take notice.

Valuation adjustments are currently underway, but various favorable factors, such as reconstruction demand, will likely emerge in the future.

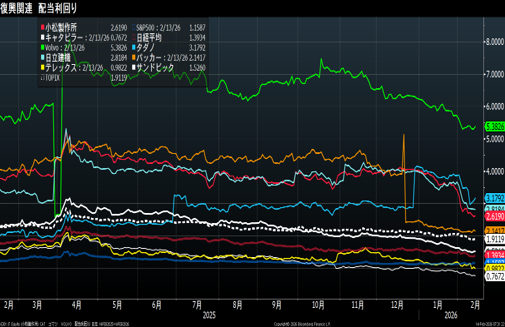

The dividend yield is also attractive. Komatsu’s is at 2.6%, significantly higher than Sandvik’s at 1.52% and Caterpillar’s at 0.76%.

– Japanese Stock Market: Value Stocks

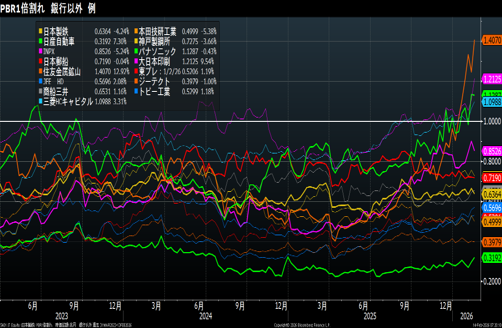

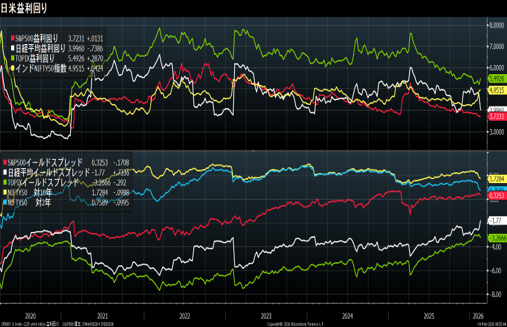

Japanese stocks are still undervalued. While the number of stocks with PBRs below 1x is gradually decreasing, 517 of the 1,665 TOPIX constituents still have PBRs below 1x (up from 534 last week). As the Tokyo Stock Exchange promotes management that focuses on capital costs and stock prices, companies are increasingly conscious of ROIC, WACC, ROE, and CAPM. In five years, the number of companies with PBRs below 1x will likely be halved.

Furthermore, with a yield spread of -3.2% for Japanese stocks, stocks are currently cheaper than bonds.

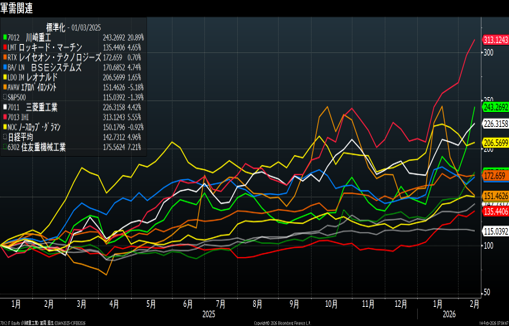

Defense-related stocks are also overpriced but strong. Kawasaki Heavy Industries rose 20.89% from last week. It had lagged behind IHI and Heavy Industries. However, Kawasaki’s P/E ratio of 34x now matches IHI’s. Will Heavy Industries’ P/E reach 64x?

Bonds: Bear Flat

In the bond market, ultra-long-term bonds are being bought, flattening the yield curve. There was a big uproar when 40-year bonds hit 4%, but bidding for ultra-long-term bonds has been brisk since then. Life insurance companies are in strong demand for high-coupon ultra-long-term bonds. I remember cancer insurance companies, in particular, buying only ultra-long-term bonds.

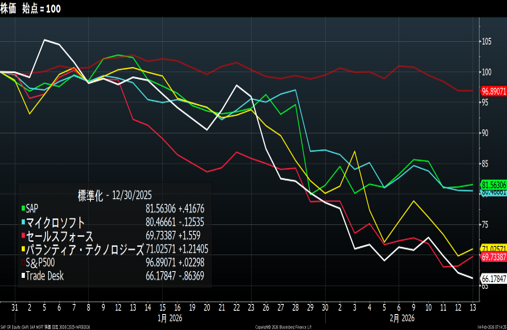

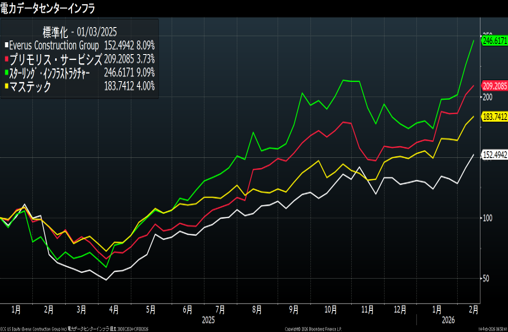

– US Stocks: From Software to Hardware

While the S&P 500 remains at a high level, software-related stocks are sluggish. Microsoft shares are down 19.5% from the end of last year, Salesforce is down 30%, and Trade Desk is down 33%. Meanwhile, Caterpillar, Honeywell, and GE Bernova are hitting new all-time highs.

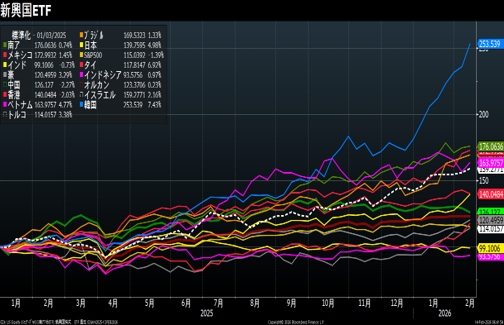

– Emerging Markets: Vietnam, Thailand, Turkey, and South Korea

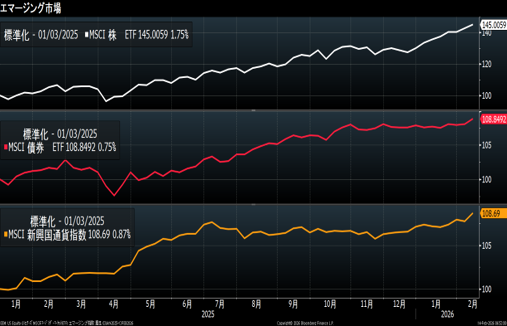

Emerging market stocks, bonds, and currencies are all rising. The stock market is particularly strong.

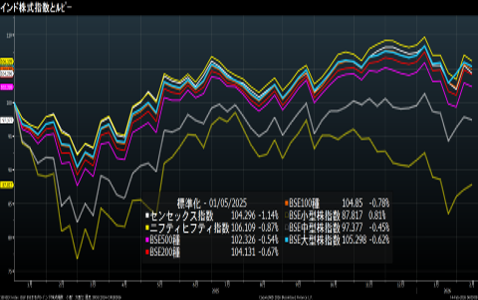

– India: Sluggish

Last week, Indian funds sold in Japan saw large inflows. However, this week saw outflows. People are shifting funds from sluggish Indian stocks to booming Japanese stocks.

Indian stocks don’t have the momentum they had two years ago.

The best way to invest in Indian stocks is through regular installments. I’m investing in an Indian fund using my NISA installment plan. I plan to gradually withdraw the funds starting 15 years from now. By then, they’ll likely have grown by about five times.

Data: Bloomberg

Certified International Investment Analyst (CIIA)

Certified Manager of Securities Analysts (CMA)

AFP

Tadashi Fujii

投稿者プロフィール

-

大学時代から株式投資をはじめ、証券会社のトレーダーとなる。以後、30年

金融畑一筋。専門分野は債券、クレジット。

日本証券アナリスト協会検定会員(CMA)、国際公認投資アナリスト(CIIA)

詳しいリンク先はこちら

未分類2026年2月14日Komatsu’s momentum is unstoppable

未分類2026年2月14日Komatsu’s momentum is unstoppable 未分類2026年2月14日コマツの勢いが止まらない

未分類2026年2月14日コマツの勢いが止まらない 未分類2026年2月7日Software to hardware. Capital is shifting dramatically.

未分類2026年2月7日Software to hardware. Capital is shifting dramatically. 未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く

未分類2026年2月7日ソフトからハードへ!ソフト企業よ、どこへ行く